How Vehicle Electrification Affects the Gas Tax

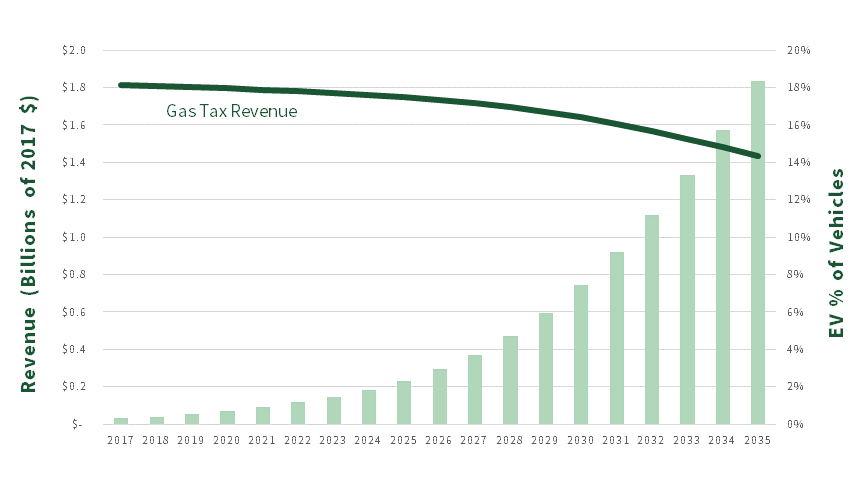

As sales of electric vehicles (EVs) increase, the revenue from gas taxes will steadily decline.

Transportation is the largest single source of US greenhouse gas emissions making up nearly 30% of the national total, and electrification is one of the most effective ways to reduce emissions.

The Federal government has set a target calling for 50% of new cars to be electric by 2030, and 100% by 2035, and many states have similar targets. Major automobile makers are on board.

Meeting the EV sales goal by 2030 would mean 14% of the fleet will be EV.

EV SHARE OF FLEET

EVs don’t use gas…yet building and maintaining transportation infrastructure and highways is still largely funded by gas taxes.

Revenue from state gas taxes average between 40% and 50% of state transportation funds.

Federal gas taxes in most states represent the next highest share and are also threatened by EV growth and improved fuel economy.

Other sources include vehicle sales taxes and registration fees and transportation infrastructure bonds.

State gas tax rates vary from 9 cents a gallon in Alaska to 57 cents in California, with most states charging 20 to 35 cents a gallon.

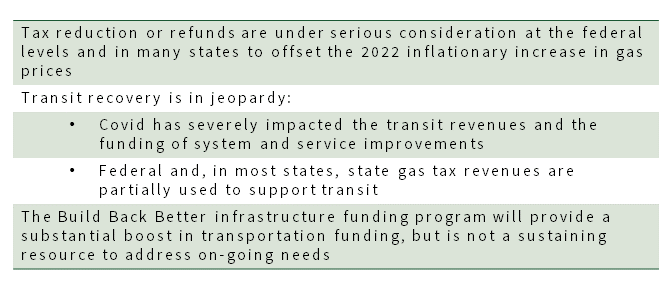

States also depend on the Federal gas tax, which has not increased since 1993, while infrastructure costs have increased substantially.

Thus, the purchasing power of those tax dollars is half of what it was in 1993. In 2022, inflation has reared its head in ways not seen in decades.

STATE GAS TAX

If EVs increase in line with forecasts, gas tax proceeds will decline by between 21% and 30% by 2035.

Improved fuel economy for conventional vehicles will further erode gas tax revenues about 9% by 2035 based on recent trends.

The Biden administration has ordered an even steeper rate of improvement, raising CAFÉ standards to 49 mpg by 2026.

Even if we were to return to historical rates of inflation, purchasing power of tax revenues will decline by 25% by 2035.

DECLINES IN TRANSPORTATION FUND PURCHASING POWER BY 2035

With EV sales increasing, how durable is our ability to build and maintain highway and transit infrastructure through current means once more electric vehicles are on the road?

How do we assess the implications and potential solutions when every state seemingly has a different funding approach?

Start by modeling projections to…

Perform revenue and expenditure projections based on state-specific gas tax rates and changes in vehicle miles traveled.

Evaluate different scenarios for addressing funding shortages based on different fleet adoption rates and mileage and tax rates.

Account for different numbers of vehicle miles travelled and resulting infrastructure impacts by EVs.

MODELING PROJECTIONS

What does this tell us?

Let’s use the State of Washington as an example…

If EVs increase in line with forecasts, gas tax revenues could reduce by 21% to 30% by 2035.

WASHINGTON REAL REVENUE

Other improvements to fuel economy of general fleet and the declining value of the dollar further reduce the purchasing power of the transportation fund.

Funding levels available for transportation improvements in 2035 could effectively be reduced to 48% to 54% of current levels.

WASHINGTON NOMINAL VALUE OF GAS TAX TO MEET EXPECTATIONS

What can be done?

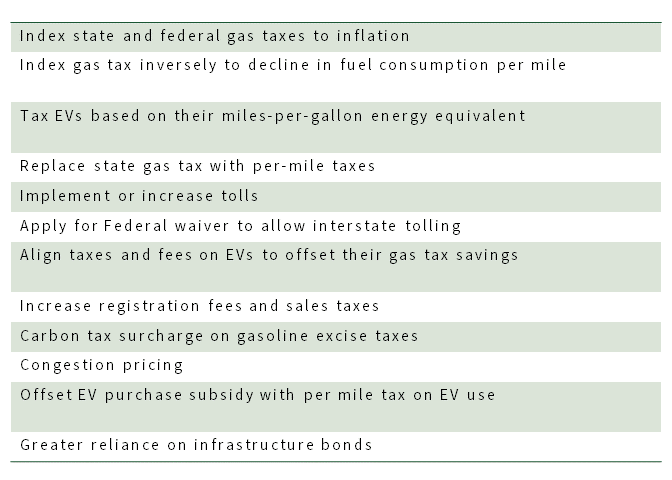

Evaluate the cost effectiveness of potential solutions to offset revenue loss, including:

Evaluate the factors affecting potential solutions and consider related areas of concern about transportation fund revenue from gas taxes.

What types of expertise does Fehr & Peers offer and how can we help you?

Data analysis, transportation, and economic modeling as demonstrated above

VMT and GHG Forecasting and mitigation including mitigation fees and infrastructure banks

Working relationships with federal and State DOTs and environmental agencies

Interested in talking more about this topic?